According to a new report by IQVIA Institute for Human Data Science, more and more patients are asked to pay high cost sharing due to changes in benefit design. Previous analysis has shown that more than six out of every ten patients (62 percent) facing cost sharing above $125 abandon a new prescription, but copay coupons reduced abandonment rates by an average of 19 percentage points in 2017. The share of patients exposed to high out-of-pocket costs, or those $125 or more, has increased 44 percent since just 2013, largely due to changes in benefit design that are shifting more costs to the deductible.

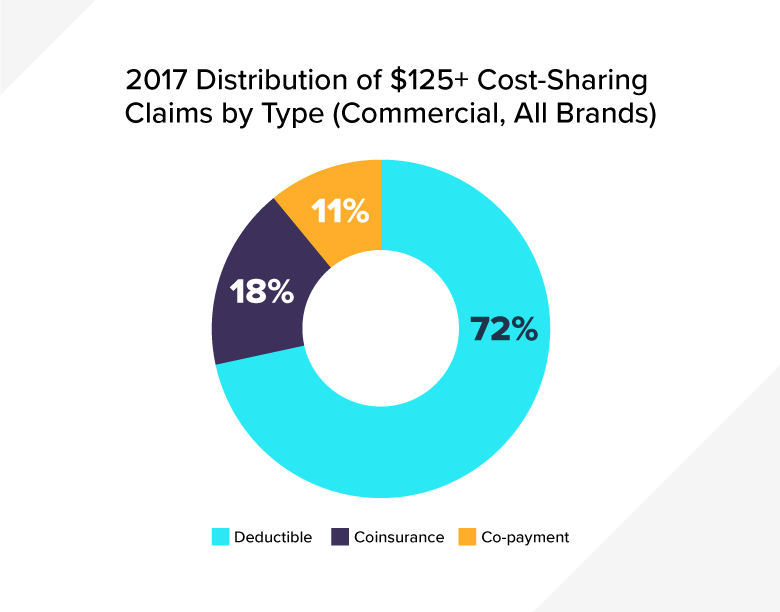

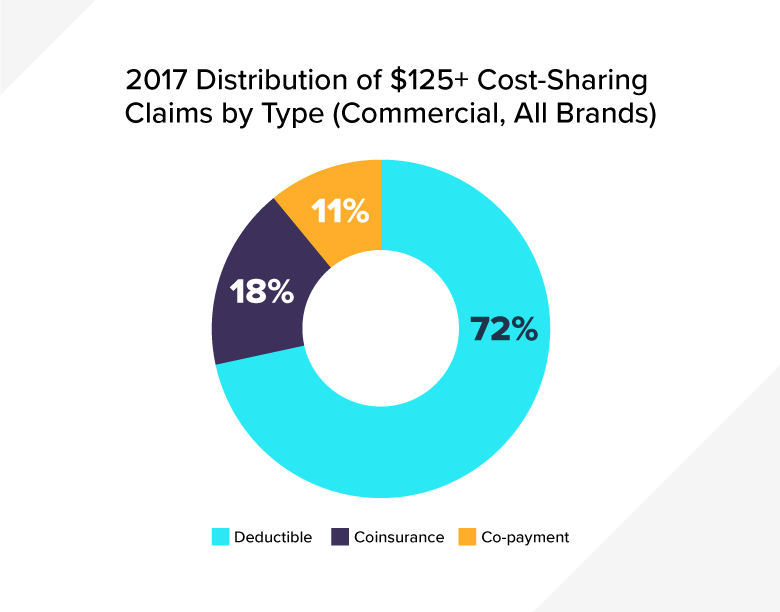

Of the prescriptions subject to cost sharing at or above $125, almost three-quarters of those prescriptions were subject to a deductible, and the share of patients with cost sharing at this level is increasing. In 2017, 13 percent of commercially insured patients had at least one prescription that was subject to cost sharing of $125 or more, but in 2013, only 9 percent of patients had cost sharing at this level.

Biopharmaceutical companies offer commercially insured patients copay coupons for some medicines to help with growing patient out-of-pocket costs. This assistance decreases patient abandonment rates while advancing public health benefits. Patients who use cost-sharing assistance cards for brand medicines, including specialty drugs, would otherwise have to pay much higher cost sharing than patients who do not use this assistance. Coupons help to mitigate this higher cost sharing. Patients with a deductible have seen their out-of-pocket costs for brand medicines increase 50 percent since 2014 and data from the Kaiser Family Foundation show patients’ out-of-pocket costs are rising faster than their insurers’ costs. Specialty drugs have the highest cost sharing and, in many cases, there are no lower cost alternatives available.

Unfortunately, insurers and pharmacy benefit managers (PBMs) have started instituting copay accumulator programs that block this assistance from being applied to out-of-pocket maximums and deductibles. This can leave patients with thousands of dollars in unexpected costs at the pharmacy, which can lead to prescription abandonment, poor health outcomes and additional spending.

Over time, how we pay for medicines in the United States has evolved into a complex system of list prices and rebates that move through an opaque supply chain. A medicine’s rebate – rather than its actual net price – often determines if it is covered or where it sits on a formulary. This creates an unfair system in which patients are often paying higher list prices that do not factor in the discount their insurer receives. This is why the industry recently announced it is advocating for reforms that prevent PBMs and other entities in the supply chain from having their compensation calculated as a percent of the list price of a medicine and instead a fee based on the value their services provide.

To learn more, visit www.LetsTalkAboutCost.org.