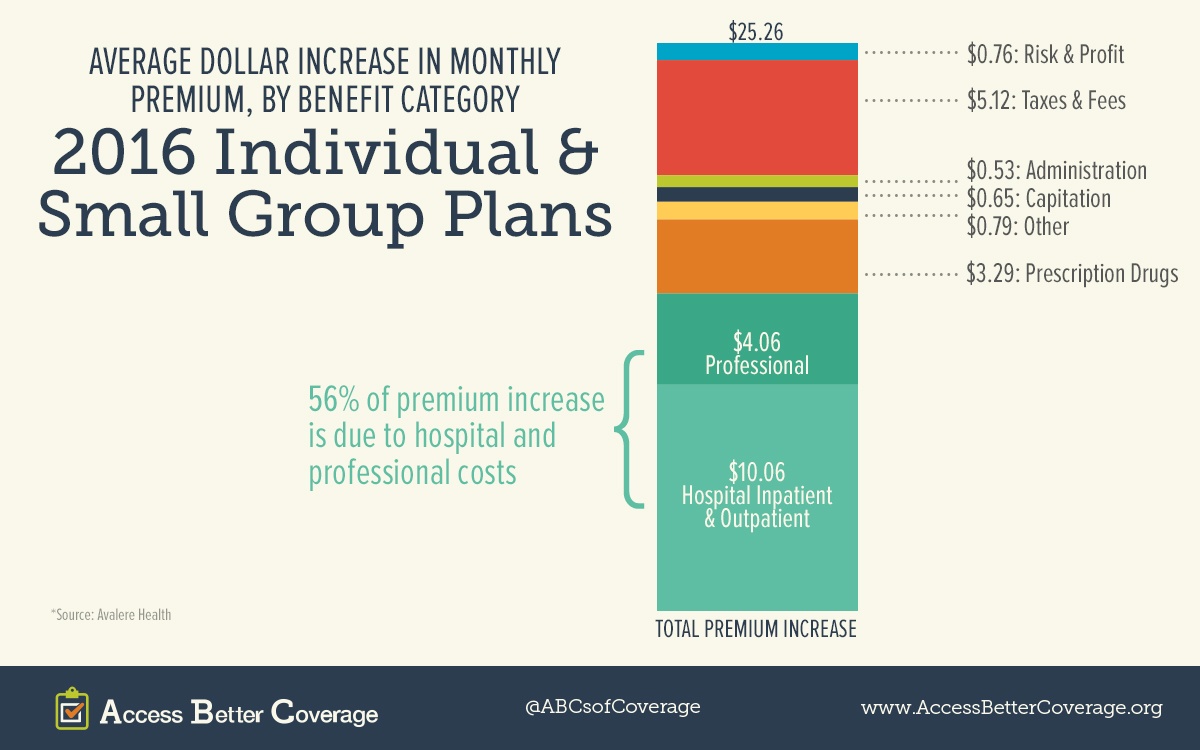

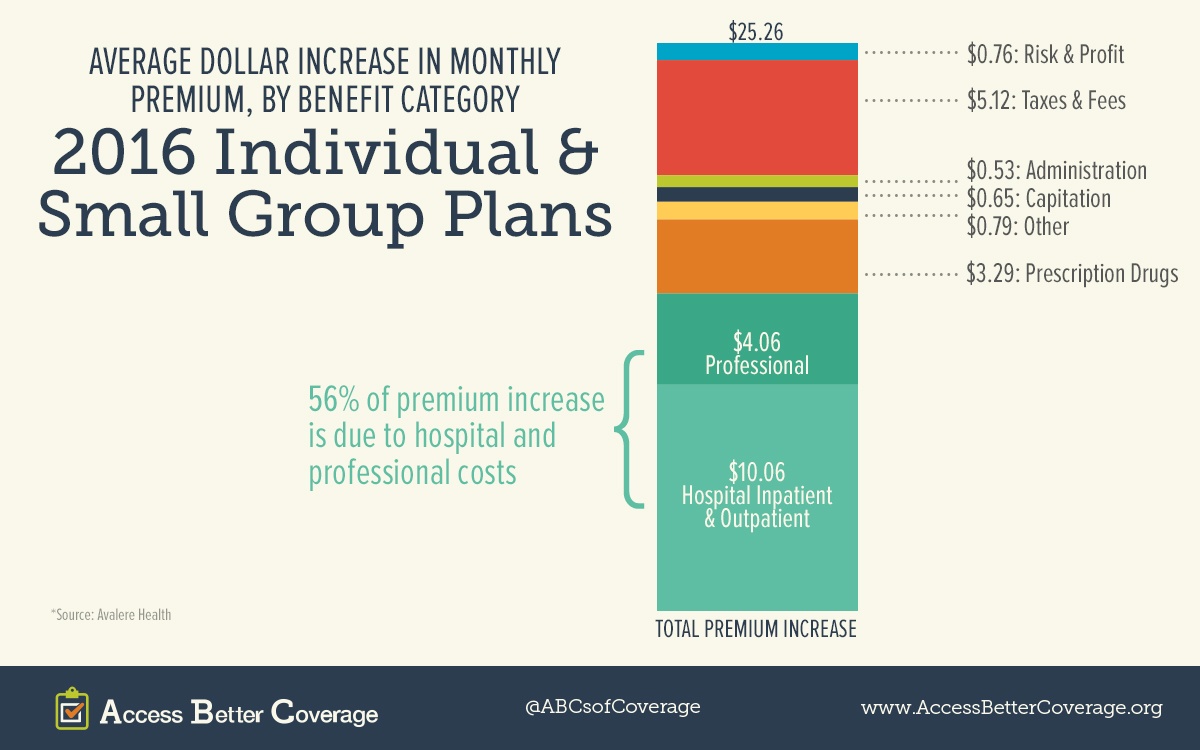

Despite claims from insurers about the impact of medicine costs on premium increases, their own data indicates otherwise. In fact, just $3.29 of the average $25.26 increase in monthly premiums in 2016 is due to prescription drug costs, according to new research released yesterday by Avalere Health. So what is driving premium increases? Avalere found that the largest driver of premium increases was hospital services.

Avalere’s analysis is based on actuarially-certified analysis submitted by the plans themselves to justify their premium rate increases. This data shows that prescription drugs dispensed at a pharmacy represent a smaller share of premium increases than inpatient hospitalization, outpatient hospitalization, professional services or taxes and fees. In fact, even if plans did not anticipate any increase in prescription drug spending, the average premium would still increase by more than $20 per month.

Avalere’s analysis is based on actuarially-certified analysis submitted by the plans themselves to justify their premium rate increases. This data shows that prescription drugs dispensed at a pharmacy represent a smaller share of premium increases than inpatient hospitalization, outpatient hospitalization, professional services or taxes and fees. In fact, even if plans did not anticipate any increase in prescription drug spending, the average premium would still increase by more than $20 per month.

Spending on hospital services and providers accounts for more than half of the average rate increase. Prescription drugs can be a part of the solution by helping to lower provider and hospital spending when patients are able to successfully manage their conditions through medicines. Even the Congressional Budget Office has recognized the unique role of medicines by adjusting its Medicare cost estimates to reflect the savings in other health care costs from increased use of medicines.

Avalere’s analysis is based on actuarially-certified analysis submitted by the plans themselves to justify their premium rate increases. This data shows that prescription drugs dispensed at a pharmacy represent a smaller share of premium increases than inpatient hospitalization, outpatient hospitalization, professional services or taxes and fees. In fact, even if plans did not anticipate any increase in prescription drug spending, the average premium would still increase by more than $20 per month.

Avalere’s analysis is based on actuarially-certified analysis submitted by the plans themselves to justify their premium rate increases. This data shows that prescription drugs dispensed at a pharmacy represent a smaller share of premium increases than inpatient hospitalization, outpatient hospitalization, professional services or taxes and fees. In fact, even if plans did not anticipate any increase in prescription drug spending, the average premium would still increase by more than $20 per month.